If you want an example of a development that probably pushed Assemblyman Vito Lopez to add all of Bushwick to the "exclusion zone" where affordable housing would be required in exchange for the 421-a tax break, look no farther than 358 Grove, a much-hyped 14-story condo tower. The building also serves as the jumping off point for a Village Voice investigation this week into landlords unscrupulously pushing gentrification in Bushwick.

If you want an example of a development that probably pushed Assemblyman Vito Lopez to add all of Bushwick to the "exclusion zone" where affordable housing would be required in exchange for the 421-a tax break, look no farther than 358 Grove, a much-hyped 14-story condo tower. The building also serves as the jumping off point for a Village Voice investigation this week into landlords unscrupulously pushing gentrification in Bushwick.In promoting 358 Grove, the developer generally plays down its location. The image at right, for example, comes from the Halstead web listing, which states "358 Grove is located in one of Brooklyn's fastest growing neighborhoods; just one block from the L train and 15 minutes into Union Square Station."

And, when the development hit the blogosphere three months ago, most comments on Curbed were withering, pointing out, for example, that the claimed 15-minute access to Union Square is a fantasy and that Bushwick is hardly close to the hipster haunts of Williamsburg.

And, when the development hit the blogosphere three months ago, most comments on Curbed were withering, pointing out, for example, that the claimed 15-minute access to Union Square is a fantasy and that Bushwick is hardly close to the hipster haunts of Williamsburg.It's worth noting, however, that the promoters have tweaked the location. Currently, the web site states, "Situated in the heart of burgeoning Brooklyn, 358 Grove offers ultra-convenient access to the myriad restaurants, shops and entertainment options of both East Williamsburg/Bushwick and Manhattan."

(Emphasis added)

In March, as the above graphic shows, the neighborhood was more boldly defined as Williamsburg.

The Voice takes a look

In a Voice article this week headlined The Second Battle of Bushwick: Thirty years after the blackout riots, it's getting hot all over again, Tom Robbins, with reporting by students in a class on urban investigative reporting at Hunter College, sketches the changes.

The article begins:

From the top of the spanking new steel-and-glass 14-story condo tower now open for inspection on Grove Street just off of Myrtle Avenue, you can see most of Bushwick—the landmarks of the neighborhood that was, and the one that's fast being remade, the sites of the bad old memories, even of some of the good.

This is the Brooklyn neighborhood's first major luxury residential construction project, but the marketers of the 59 condominium units for sale here steer clear of the name Bushwick as much as possible. Promotional materials aimed at luring hipsters with the means to buy a one-bedroom for $270,000, or a three-bedroom penthouse for $682,000 refer to "ever-expanding Williamsburg" or "East Williamsburg" as the building's locale. This despite the fact that the tower at 358 Grove Street is in deepest Bushwick; look it up on any map.

...What's at work here is straight out of the brokers' handbook: Link the property in buyers' minds to the worldwide cachet of that now-prosperous and booming neighborhood a couple miles west of here. "The Peter Luger Steakhouse is just a couple of blocks away," the agent says, leaning over an unfinished rooftop cabana. Actually, Peter Luger's is a solid eight subway stops away from here on the M train that rumbles along Myrtle Avenue. But no matter. There are some very solid marketing rationales for this approach.

Why? Bushwick burned in 1977, during the blackout July 13, and residents looted the neighborhood, which the Voice describes as such: Pummeled by the loss of its blue-collar, job-generating breweries and knitting mills in the late '60s and early '70s, the neighborhood underwent a wrenching racial transition as low-income blacks and Hispanics replaced fleeing Italian and German families.

Then came drugs--indeed, those at 358 Grove Street can see down Irving Avenue to Maria Hernandez Park, named in 1989 for a heroic local activist who "confronted the local crack merchants," as the Voice puts it, and was shot to death, with no arrests.

There's an excellent exhibit on Bushwick's recovery at the Brooklyn Historical Society, called Up From Flames, through August 27. Public disinvestment fostered the neighborhood's decline, and public investment to rehabilitate and build affordable housing helped stabilize the neighborhood before gentrification.

Gentrification

As in Williamsburg and the Lower East Side, the Voice notes, "artists are the shock troops of gentrification," willing to adapt industrial spaces and to live alongside poverty, they spawn bars and restaurants and soften up the neighborhood for development. It's happening all along the L train.

And gentrification isn't necessarily bad, as the Voice observes:

A neighborhood that ranks in the top 10 poorest areas of the city, that has the highest rate of asthma hospitalizations and the most serious housing-code violations, can use all the help it can get. New investment means new residents, new stores, new jobs. And, whether city fathers choose to admit it or not, it means much closer municipal attention to crime and the quality of local life. For those who already own a modest piece of the rock, and who held on through the bad years, rising real estate values also yield a once-in-a-lifetime bonanza, a hike in net worth that trickles down to the rest of the family, providing a nice cushion against an otherwise fickle economy.

The problem is that some people lose out, those living in buildings of fewer than six units, which are not subject to rent regulation. And, as the Voice points out, even those in buildings subject to rent regulation are under siege:

But those in rental buildings of six apartments and over—roughly half of Bushwick's housing stock—are supposed to enjoy the full protections of the law. They're entitled to basic services like a paint job every few years, regular visits by an exterminator, and a locked front door, not to mention security against illegal rent hikes and harassment. But try telling that to the avid buyers now answering the clarion call of a new hot real estate market in, of all places, Bushwick. In the past two years, residents and community groups say, new landlords have flocked to this once woebegone territory, their apparent mission to empty and re-rent these now valuable properties—regardless of the rules—as fast as possible.

The rest of the article chronicles the "huge displacement going on," and points out that, in some cases, city officials are trying to enforce housing codes to stop unscrupulous landlords.

Up From Flames

The real estate market is in flux, as Adam Schwartz writes on Up From Flames:

One measure of a successful public policy is the extent to which it encourages private investment. By this measure, the redevelopment of Bushwick has been a roaring success.

But such success can also be a danger to itself. It was a mad dash for profit that started Bushwick's burning 30 years ago, just as that same force is sending both rents and buildings sky high in todays hot real estate market.

True sustainability is about balance and public policy is needed once again to provide that balance. Bushwick currently needs affordability, zoning and historic preservation laws to maintain the community's neighborhood feel.

True sustainability is about balance and public policy is needed once again to provide that balance. Bushwick currently needs affordability, zoning and historic preservation laws to maintain the community's neighborhood feel.In the New York Observer this week, Matthew Scheurman's article, headlined Grinding Sausage Late at Night: Albany Reforms 421a Program, explains why certain neighborhoods were added to the exclusion zone:

An old-school politician who understood that housing was a bread-and-butter issue for his working-class Hispanic constituents, Mr. Lopez held an unusual amount of power both as the head of the Assembly’s Housing Committee (meaning that any bill would have to go through him) and as the new head of the Brooklyn Democratic Party (meaning that he had particular pull with fellow legislators from his borough).

The 421a reform was an easy sell for his colleagues, especially those who represent poor and minority areas that the Sunday New York Times real-estate section was calling the next hot neighborhoods. To these legislators, the 421a program appeared to symbolize the government’s complicity in gentrification, for it gave developers an incentive to tear down tenements and replace them with new, higher-priced apartment buildings. The fact that the people who voted for these Assembly members were the ones being driven out made the point all the more clear.

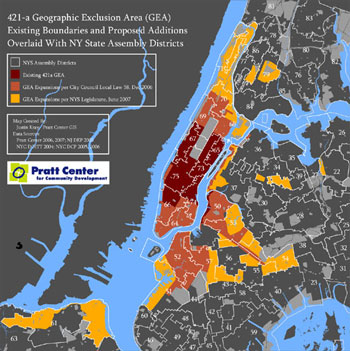

When Mr. Lopez asked for input on the bill a few months ago, he said he received responses from 17 legislators who wanted some or all of their districts to be added to the exclusion zone; these would be neighborhoods where the 421a tax break would be reserved only for new buildings that included low-income housing. Three of those legislators later changed their minds, Mr. Lopez said.

The 14 legislators who asked to be included did not necessarily represent neighborhoods that were far enough along in gentrifying that market-rate housing needed no boost to take root. Rather, they represented that swath of minority neighborhoods where displacement fears raged most fiercely. The exclusion zone that Mr. Lopez offered in his bill extended north in Manhattan through Harlem, Washington Heights and Inwood; east through central Brooklyn to encompass large parts of Crown Heights, Ocean Hill, East New York and Mr. Lopez’s entire district. The northern shore of Staten Island, and small spots in Queens and Bronx, were also mapped.

And why weren't areas like Riverdale or Corona added? The legislators didn't ask.

AY echoes?

In the Atlantic Yards context, Forest City Ratner hasn't had to withdraw services from the buildings it owns that are slated for demolition. For one thing, the large developer is subject to more public scrutiny than some shadowy investors in Bushwick. More importantly, Forest City has the ultimate hammer; the state will exercise eminent domain.

However, a property owner just two doors down from the AY footprint, at 499 Dean Street, last fall bricked up the building and allegedly withdrew services to get a rent-regulated tenant to leave. (That threat seems to have passed, as there are now new windows.)

And gentrification in the area around the Atlantic Yards site has already begun. In some cases, investors are building on empty lots. In others, buyers are jacking up rents.

The Prospect Heights/Crown Heights area, as Brooklyn College sociologist Aviva Zeltzer-Zubida pointed out, is ripe for displacement. Maybe that's why Lopez's bill, however flawed, extended the 421-a exclusion zone to Crown Heights. His argument was the public should not, as with 358 Grove, subsidize luxury development without getting something in return.

The new 421-a map certainly does not, as the Observer suggests, represent the best balance to nudge the housing market along. Then again, the City Council reform, with a more modest "exclusion zone," isn't necessarily the solution.

It all shows the difficulty of trying to predict the housing market. And there are other factors; "Up From Flames" points out that the zoning in Bushwick allows larger buildings, which are another incentive for profit.

great article. i live near the area and my area, although nicer, is the product of this same type of real estate manipulation. when i got here it was east williamsburg (which in my mind justified the price for this loft) after 6 months i was told i actually live on the edge of bushwick that this area was in fact called bushwick. well fancy that.

ReplyDeleteBolpf WHistzer - You and people like you are idiots b/c you overpay for something in which you have no idea what it is you're getting, and in turn help keep the real estate market unjustifiably high for areas such as the one in this article. I'm not from NY but could smell something fishy when I first heard a broker mention the name East W'Burg. So what did I do w/that suspicion? Easy, I simply ASKED a few people, about this notion, and they all laughed at the idea.

ReplyDeleteIn conclusion, maybe NY real estate prices will go down a bit if idiots armed w/their parents' money and no concept of real estate research/negotiation will slow down for a second and do some research.

Am I angry and did I make certain assumptions? Yes, but you ARE symbolic based on your comment.